Your brand exists to make people take selective action. Gather your evidence base to focus their action on the outcomes you want.

Cate Newsom | JANUARY 12, 2016

IN HIS OVERVIEW of Evviva’s brand building process my colleague David Kippen wrote, “brands have a job: to make people take selective action.” In order to have credibility, your brand position must be accurate and authentic. This means taking a global view and asking the right questions in order to uncover your brand’s unique selling points–its evidence base. Sure, “evidence-based” everything is the order of the day, but the reason an evidence base is fundamental in medicine is the same reason it’s fundamental to your brand position: personal beliefs and expectations can prevent us from seeing the full picture, and distinguishing signal from noise. (Prefer to listen? Now you can hear this post on Express, our podcast.)

Just as each of us may mean many things to many people – parent, child, friend, rival, boss, report, teacher, student – so do our companies mean different things to different audiences. An investor’s view of the success of Apple’s iWatch is completely different from a consumer’s view of what the product might do for her. You may not give much thought to whether the inks that HP Inc. makes are water soluble, but if you’re an environmentally-conscious beach comber who finds loads of them washing ashore around the UK, you’ll likely have a different view. Whether you think more staffing cuts at Yahoo are a good idea or not may depend on whether you’re an employee or an investor—but if you rely on Yahoo mainly for news and mail, you’re less likely to care. All of these views are important. Some are long-term propositions (the iWatch), some are short-term (the layoffs) some are unplanned (the cartridges), but they’re each part of the gallery of impressions that inform what people think about your brand. Distilling the essence of our companies’ promises in each of these different roles, mixing in the right balance of notes from each, is the recipe for brand success. To do this, you have to go out and gather the ingredients.

Chances are, your company has stockpiles of data at the ready, and quant-focused analysts eager to make use of it. Employee engagement surveys, customer satisfaction surveys, behavioral analytic reports – evviva! These are a great place to start (and to validate). But as you dig in, there are some essential steps to take on the qualitative side that will help you focus your efforts on the right targets and ensure you’re asking the right questions, to get the balance right.

Who? Take stock of your brand’s stakeholders

It may sound simple, but this step will be enlightening and will ensure that your brand reflects the role your company plays for each of its audiences. This step requires you to identify all the categories of relationships your brand has, and all the people who are invested in your brand, or should be. This list generally includes employees, leadership, and customers, but may also include regulators, representatives of the communities where your organization operates, suppliers, investors, financial analysts (especially if your company is a startup), trade union organizers, even academics in programs that provide your company with critical research or new hires. What does each one ask for when he walks through the door? How does the ask change over time? Create a chart to document any common threads among these stakeholders as well as their behavior patterns or profiles to categorize each stakeholder relationship. Wherever you find you’re drawing a blank, you’ll know you need more information. (Later, you can return to this chart to develop your message hierarchy and social media strategy.)

Where? Locate key brand encounters

Where are critical conversations about your brand taking place? What are key touchpoints in your brand experience? Locating these critical points is important for two reasons. It tells you exactly where you need to go to observe and assess your brand in action. Then, in the brand expression phase, it enables you to focus your brand work in time and space to make the greatest impact. There are numerous ways to do this, and not all of them will work for every brand. Here are a few general activities that can help you get started.

Develop a roadmap

First, map the brand journey of a member of each target audience – whether she’s an employee, a customer, an investor. How did he or she first encounter your brand? What was the uptake process? How long did the engagement last? Why did he eventually leave? For brand loyalists, why do they stay, particularly when things get bumpy?

Another useful process is to document a “day-in-the-life”-of current customers, users and employees. This will yield vital insight into where impressions are being formed – and where better care is needed. In some cases, brand touch points are physical or virtual spaces.

Threshold potential

The most obvious of these are points of entry: landing pages, lobbies. If you’re a B2B company, you may not think an investment in your lobby would have a positive impact on your bottom line – which is why it may resemble an early 1990s dental practice. What does your client think when she walks in for an appointment? And how does the employee who receives her react—by immediately making excuses? All parties may adjust their attitudes accordingly, and suddenly everything is just a little more lackluster – even though your company happens to be an industry leader in Silicon Valley, a petrochemical titan, a travel sector innovator. (One interviewee from a thriving company with an un-renovated global headquarters recently commented, “We’re doing great, but our lobby is having financial problems.”)

Similarly, an employee may have a defining brand experience each day at the entrance to /exit from work, depending on the visual and verbal messages that greet her. For the employee, will that be a message that invokes the company’s values, the employer brand promise, an employee-directed experience of the service promise the company makes to its customers? Or will it be a reminder not to steal from the cafeteria? (We have come across both.)

Meanwhile, we see much that is analogous in those online lobbies, the landing pages of corporate websites. Being highly regulated is no excuse for having a landing page full of tedious, tiny text, stock photography, or worse yet, remnants of the staff photo shoot 10 years ago. Yeah, I’m looking at you, global law firms and accountancies of all kinds. (But I do like the sideburns.)

Of course, your brand delivers many more online brand touchpoints than the corporate and career site landing pages. Some of them you can control, some you can influence only indirectly. A word of caution: it is possible to get lost in the weeds of documenting connections. To avoid this, you’ll want to prioritize the touchpoints that matter most. Be sure to include both paid and earned media in your review, and note that there will generally be different paths to conversion on social channels. How much volume does your company see on twitter, and how responsive is the company to tweets? What metrics do you measure? Which hashtags, which threads yield the best conversations?

Use the purchase funnel

A starting point is to consider the brand experience through the lens of a traditional purchase funnel. This will help you locate where the transactions take place, and recognize how the messages need to differ from stage to stage. For example, if you’re oilfield giant Schlumberger, chances are good that your buyers already have a high awareness and good opinion of you. Given that basis, you’ll focus on how you stack up in the consideration, preference and purchase stages. In contrast, if your brand is a B2B startup like Slack, even though word of mouth may be brilliant, you’ll eventually spend heavily on general marketing to create awareness. In this scenario, you’ll likely focus on the discrete groups that enter the top of the funnel (awareness), the bottom (purchase) and the ratios between them by audience.

Visual data

The permutations may seem endless, but there are many ways to determine the hierarchy that works for your brand. Visualizing data at this point can be extremely helpful. One straightforward approach is to create a heat map of conversations and conflicts. This will illustrate which locations generate the most activity, and merit further investigation. Later, in your brand expression phase, you can use this map to redirect, enhance or refine the messages your brand is delivering. Because, once again, your brand has a job to do. It exists to make people take selective action.

How and why?

Once you’ve identified key audiences, processes, and locations, it’s time to gather insight. Select your methods to suit your audiences and locations, but whatever combination of approaches you use, make sure your investigative team is neutral and approaches the task tabula rasa. It’s hard to keep an open mind when the feedback is so personal. It’s even harder to give honest feedback directly to the person it affects (and may hurt). And when it comes to internal insight, it’s never going to happen if the people providing feedback are afraid of losing their jobs.

For these reasons, we recommend that you send external observers to gather information about your brand’s relationships. Ideally, you’ll hire resources with strong skills in facilitation and ethnography. If you do hire externally, provide your resources with full access to your organization and customers. If you can’t trust them, you shouldn’t hire them. If you do trust them but don’t permit them the access they need to do their jobs, the results you get back will reflect the blind spots they experienced. (Whatever you do, never send HR when you’re looking inside your organization. While HR staff generally care a great deal about the work and will take it very seriously, any time HR is in the room, it sends a message that most employees will find impossible to tune out.)

You will almost certainly be surprised by the depth and range of information that comes back. You are likely to discover a parallel need for strategic realignment or re-training as well as other small structural changes to resolve location-specific challenges. These “surprises” are an added bonus of brand insight work and will make your organization stronger.

Having followed these three steps, you should now know exactly who is invested in your brand (or should be) and where those critical conversations and brand encounters are taking place. You should also have created a handy chart of stakeholder profiles, a heat map of conversations in the physical and virtual worlds. And you will also have gathered meaningful observations about the current, lived experience of your brand through strategic site visits and conversations with key participants. Your brand laboratory is stocked; you now have all the ingredients to develop an authentic, accurate brand position built around your key equities and differentiators as well as a strong understanding of what makes people take selective action at each stage of the purchase or employment funnel. This is where the brand strategists step in and the brand alchemy begins.

Cate Newsom is Evviva Brands’ Head of Insight. She and her team deliver the insights that serve as the foundation for Evviva’s global brand strategies. Cate has worked with leading multinational corporations in energy, financial services, consumer packaged goods, management consulting, and technology. Her background includes documentary film (with a BA in film from Yale University, and a Master’s from NYU), anthropology (with a Master’s from U. v. Amsterdam), and extensive field research experience. She has settled in six countries and has a working knowledge of six languages.

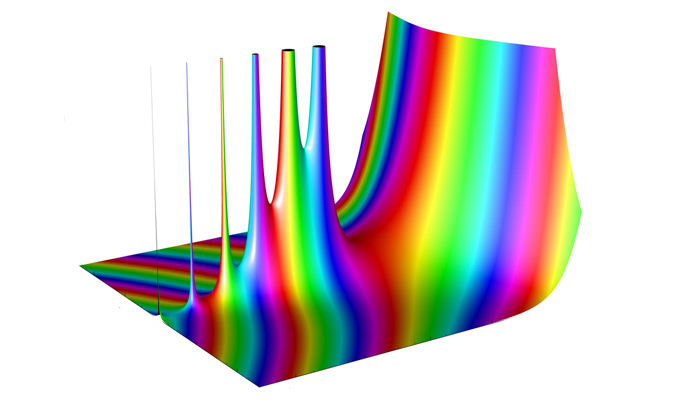

– Post image credit: © 2010 Geek3 – ‘Gamma abs arg.png’

Submit a Comment